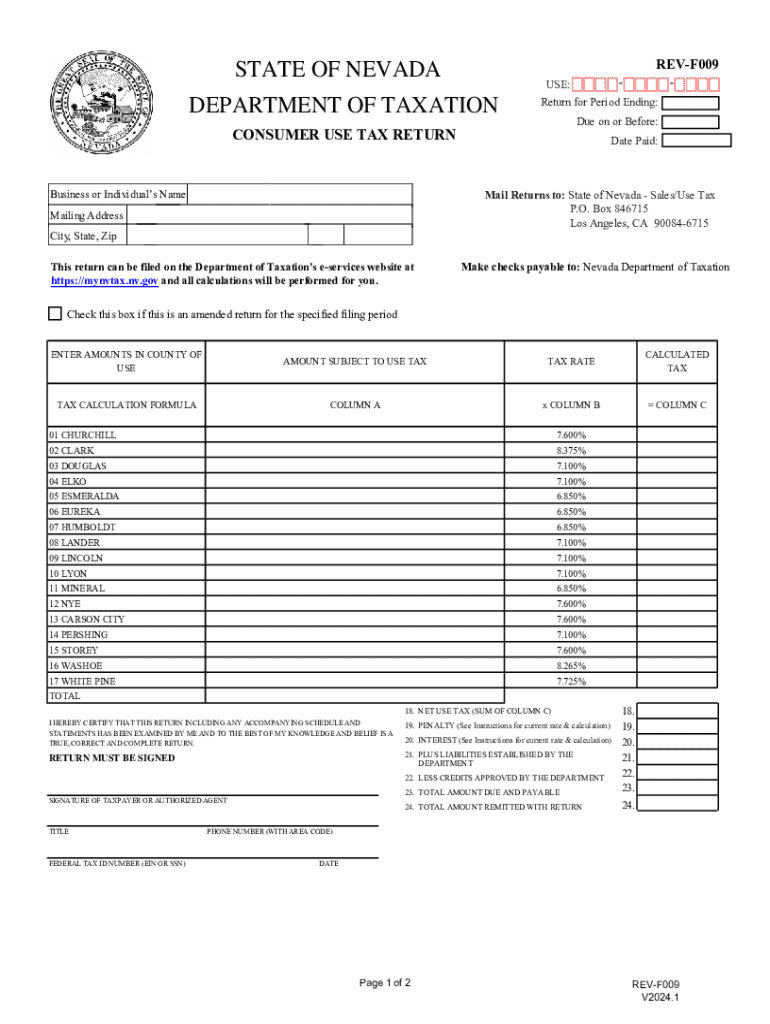

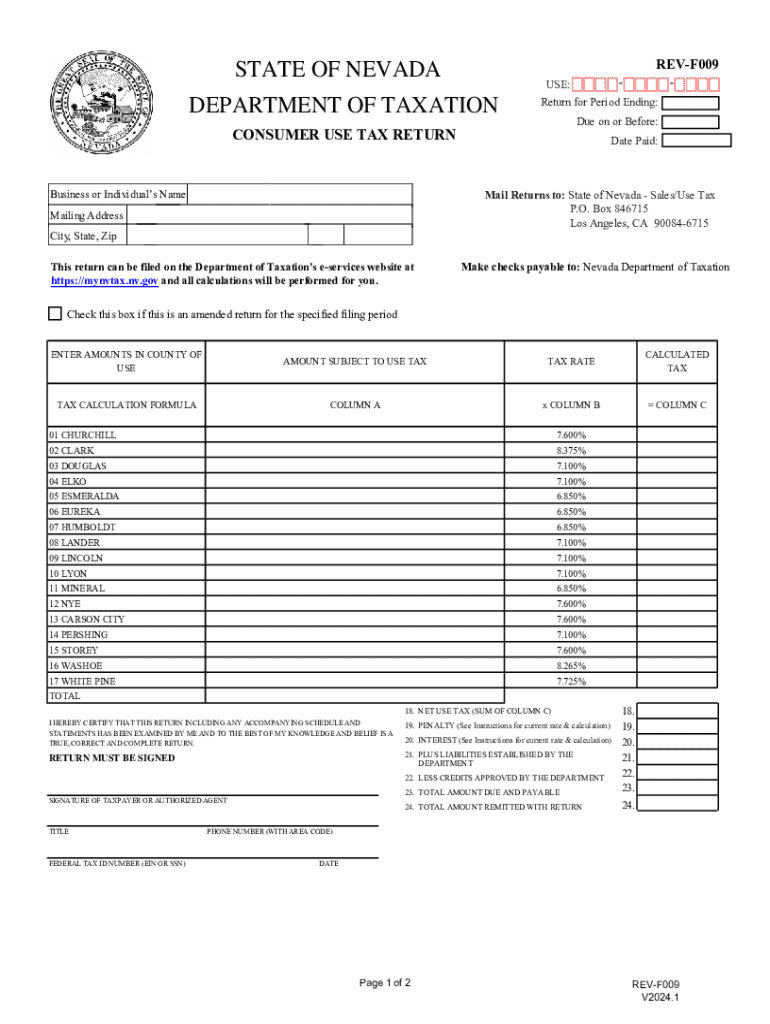

NV REV-F009 (Formerly TXR-02.01) 2024-2025 free printable template

Get, Create, Make and Sign NV REV-F009 (Formerly TXR-02.01)

Editing NV REV-F009 (Formerly TXR-02.01) online

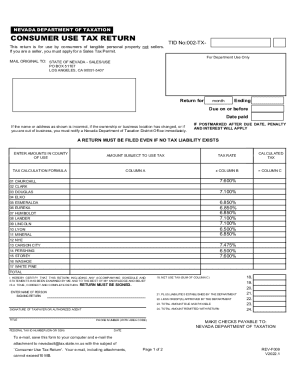

NV REV-F009 (Formerly TXR-02.01) Form Versions

How to fill out NV REV-F009 (Formerly TXR-02.01)

How to fill out NV REV-F009 (Formerly TXR-02.01)

Who needs NV REV-F009 (Formerly TXR-02.01)?

Instructions and Help about NV REV-F009 (Formerly TXR-02.01)

Laws calm legal forms guide form 2290 is United States Internal Revenue Service tax form used for filing a heavy highway vehicle use tax return this is a yearly excise tax on trucks used in the United States and one form must be filed for each truck a form 2290 can be obtained through the IRS website or by obtaining the documents through a local tax office the form must be filed with the IRS just like any other tax return begin by filling out your contact information on the top of the form put you or your corporations name an employer identification number and your current address including street city and state next you must determine the tax amount in part 1 first indicate if the truck was on the road in July 2011 and if yes enter 2 0 1 1 0 7 on line 1 using the tax grid on the second page of the form 2290 determine the tax rate of your vehicle using the weight of your vehicle and type of work the vehicle performs determine your tax rate if you have multiple trucks add up the total tax amount and put this number on line 2 if your taxable gross weight increased at any point during the taxable year you must indicate the additional tax amounts on line 3 and up your total taxable amount and put this total on line 4 if you have any applicable tax credits put the amount of tax credits on line 5 subtracting your taxable amount from your tax credits you will get your final tax obligation under the heavy highway vehicle tax this is the amount you must pay the IRS if you have a vehicle that was used under the minimum to be taxed indicate this status in part 2 your trucks may not be taxed or may be limited by how much they can be taxed complete part 2 certifying you have suspended vehicles if applicable to your trucks otherwise continue to the final boxes and certify your form 20 to 90 attach the schedule 1 of your form 20 to 90 which requires you to indicate the VI n number of each truck you are reporting the form is ready for submission to the IRS keep a copy for your records to watch more videos please make sure to visit laws comm

People Also Ask about

Who needs to file Nevada Commerce tax return?

What is Nevada sales tax certificate exemption?

How do I download old 1040 from the IRS?

Does Nevada have a state tax ID?

Is there a state tax form for Nevada?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my NV REV-F009 (Formerly TXR-02.01) in Gmail?

How can I modify NV REV-F009 (Formerly TXR-02.01) without leaving Google Drive?

How do I make changes in NV REV-F009 (Formerly TXR-02.01)?

What is NV REV-F009 (Formerly TXR-02.01)?

Who is required to file NV REV-F009 (Formerly TXR-02.01)?

How to fill out NV REV-F009 (Formerly TXR-02.01)?

What is the purpose of NV REV-F009 (Formerly TXR-02.01)?

What information must be reported on NV REV-F009 (Formerly TXR-02.01)?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.