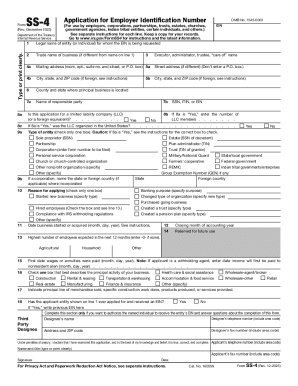

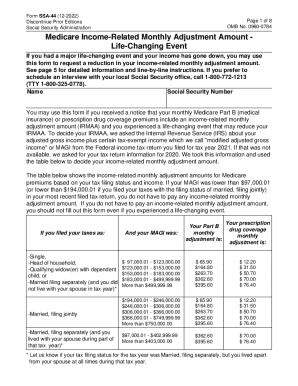

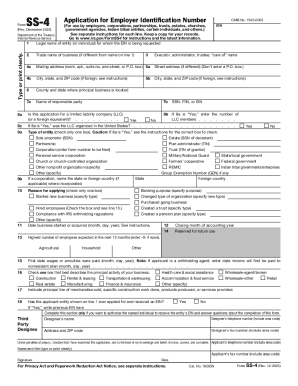

What is Form SSA 44?

Form SSA 44 is called the Medicare Income-Related Monthly Adjustment Form. You must complete this form if you have faced some crucial life-changing events which have decreased your total income.

What is Form SSA 44 for?

This form is specially designed for requesting some reduction in the income-related premium of your Medicare Part B. If an applicant receives a notice informing about the reduction of income, the next step must be filing Form SSA 44.

When is Form SSA 44 Due?

The form does not have a deadline. The time frame of the document depends on some factors. It may be different for different people as their life-changing events may never coincide.

Is Form SSA 44 Accompanied by Some Other Documents?

You must attach the evidence of the life-changing event to your Medicare Income-Related Monthly Adjustment Form. All copies must be certified and signed by the public notary. Pay attention that you provide correct documents with all necessary information.

What is the Structure of Form SSA 44?

First, you must indicate your full name and social security number in the form. The document itself includes the detailed guidelines how to complete every single field in the form. After that you must indicate what life-changing event has occurred. It may be a marriage, work reduction, divorce, annulment, spouse death, loss of pension income, work stoppage, loss of income due to property loss, etc. Type the date of this event. The next part of the form is devoted to the reduction of income. You must indicate the tax year, adjusted gross income, tax-exempt interest and filing status. Your next step is to describe your modified adjusted gross income and provide the documentation that proves the reduction. The last step is your signature.

Where do I Send Form SSA 44?

Your form must be sent to the Social Security Administration.