IRS W-4 2024-2025 free printable template

Show details

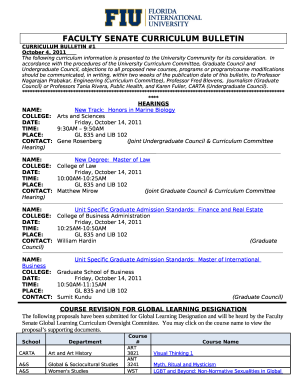

FormW4Department of the Treasury Internal Revenue ServiceStep 1: Enter Personal InformationEmployees Withholding CertificateOMB No. 15450074Complete Form W4 so that your employer can withhold the

pdfFiller is not affiliated with IRS

Instructions and Help about W-4 Form 2025

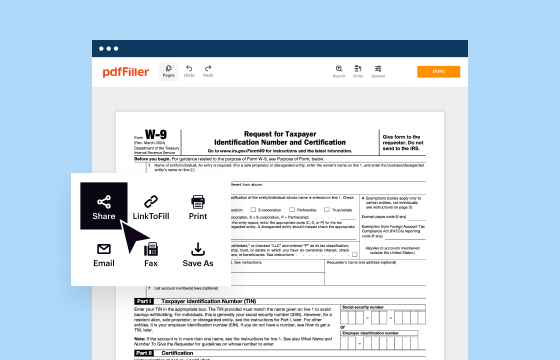

How to edit IRS W-4 2025 online

How to fill out the W-4 withholding form

Video instruction

Instructions and Help about W-4 Form 2025

Easily handle your tax forms and streamline your document completion process.

How to edit IRS W-4 2025 online

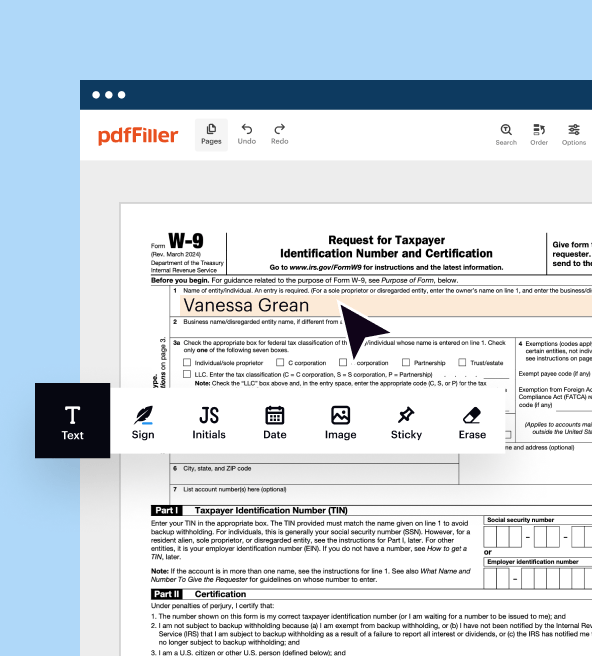

Use the instructions below to start using our professional PDF editor:

01

Get pdfFiller account. Register and sign in to access our online editor.

02

Upload a document. Click Get Form at the top of the page and wait for it to upload.

03

Edit and fill out the federal W-4 form. Easily rearrange, rotate, and add pages, complete fillable fields, insert images, and more.

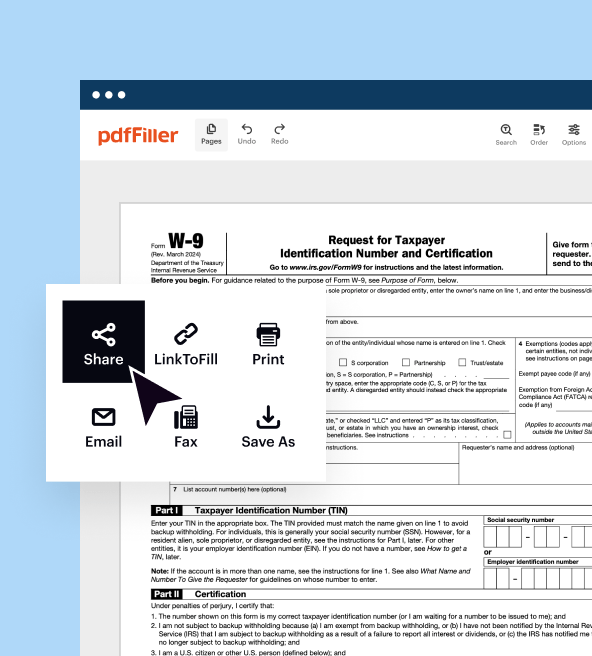

04

Share complete form with IRS. Download or share your form via link, email, or send it directly to the IRS.

pdfFiller makes working with documents easier than ever. Create an account to find out for yourself how it works!

How to fill out the W-4 withholding form

Prepare for the upcoming tax season and manage your W-4 Form with ease.

01

Obtain a copy of the 2024 Form W-4 from the Internal Revenue Service (IRS) website or your employer.

02

Read the instructions carefully, as they provide essential information on how to fill out the form.

03

Begin by providing your personal information, such as your name, address, and social security number.

04

Determine your filing status. This depends on your marital status and whether you are claiming any dependents.

05

If you have multiple jobs or are married and you and your spouse are employed, follow the instructions on the form to calculate the appropriate withholding allowances accurately.

06

Consider any additional income you expect to receive during the year, such as interest or dividends, and follow the instructions for reporting these amounts.

07

If you wish to have additional tax withheld from your paycheck, indicate the amount in Step 4(c).

08

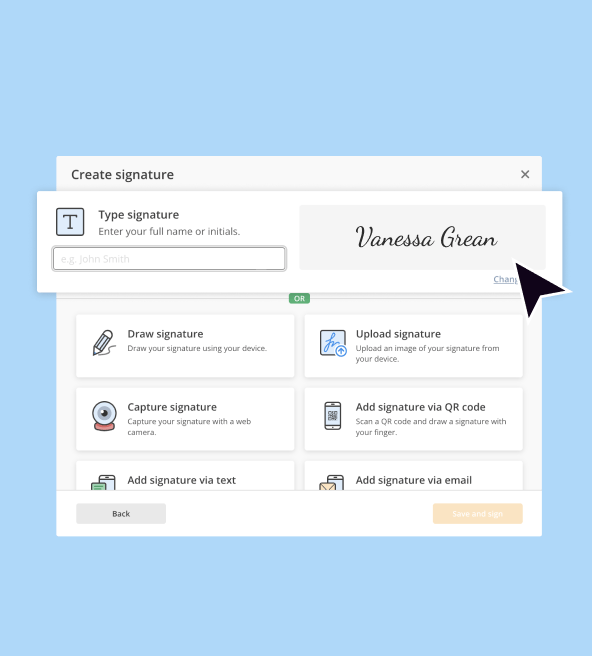

Sign and date the form.

09

Submit the completed Form W-4 to your employer. They will use the information provided to calculate the amount of federal income tax to withhold from your wages.

Video instruction

Show more

Show less

New Updates to

Changes to W-4 tax form

Submitting a New IRS W-4 2025

New Updates to

Changes to W-4 tax form

The IRS updated Form W-4 in 2020 to incorporate changes enacted by the Tax Cuts and Jobs Act, including an increase in the standard deduction and the elimination of personal exemptions. These updates aim to simplify the W-4 and make it easy for taxpayers to fill out.

Submitting a New IRS W-4 2025

Employees should consider submitting a new Form W-4 annually, whenever their personal or financial situation changes or a significant tax law amendment is enacted. For example, changes in marital status, having a child, purchasing a home, or variations in income can significantly affect tax liability, requiring adjustments in withholding amounts.

All You Need to Know About W-4 withholding

What is the W-4 withholding form?

Who needs 2025 form W-4 employees?

Exemption from Withholding

What information do you need to provide in form W-4?

Is IRS W-4 2025 accompanied by other forms?

Federal W-4 form and its Components

When is the W-4 form due date?

Where do I send my printed W-4 form?

All You Need to Know About W-4 withholding

Get ready for the upcoming tax season with pdfFiller: obtain W-4 2025 PDF, fill it out, and share it with the IRS right away.

What is the W-4 withholding form?

The IRS Form W-4 is an income tax withholding document that employees must complete. This form provides employers with the required information to withhold the correct federal income tax from the employee's paycheck.

Who needs 2025 form W-4 employees?

Anyone who is an employee and is subject to federal income tax withholding needs to fill out the 2025 federal W-4 form. This includes individuals employed by companies or organizations with a payroll system. Employers must have a completed Form W-4 on file for each employee to ensure accurate withholding of taxes from the employee's wages.

Exemption from Withholding

If you owed no federal income tax in 2024 and expect the same for 2025, you may qualify for exemption from withholding. If you meet these criteria, write “Exempt” under Step 4(c) and complete Steps 1(a), 1(b), and 5 only. Exemption status must be renewed each year by February 15.

What information do you need to provide in form W-4?

When completing your W-4 form, you need to provide the following information:

01

your data (full name, address, SSN, marital status);

02

whether you hold more than one job or your spouse also works, and you file jointly;

03

whether you have extra income, not from jobs (dividends, interests, etc.);

04

the number of children and other dependents;

05

the amount of deductions you expect to claim;

06

any additional tax to be withheld;

07

your employer's details (name, address, EIN) and your first date of employment;

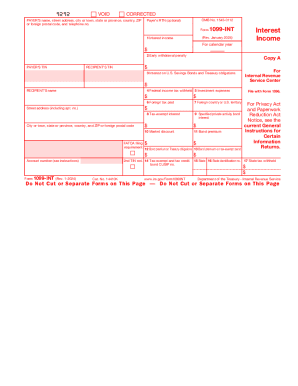

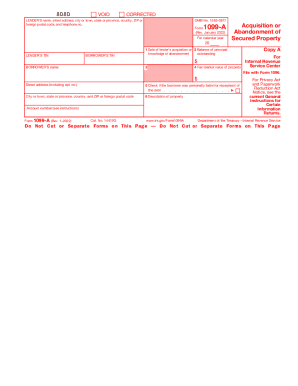

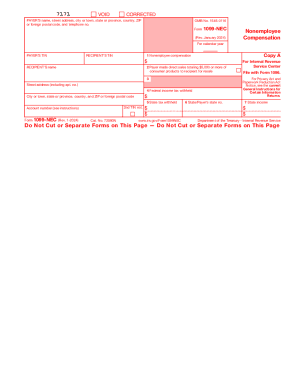

Is IRS W-4 2025 accompanied by other forms?

There are only exceptional cases where you need to fill out additional documents. For example, if you have any interest or dividends, you may want to fill out a 1040-ES template to estimate your taxes.

Federal W-4 form and its Components

Step 1: Filing Status

Choose your expected filing status to set your withholding rate and standard deduction.

Step 2: Multiple Jobs or Working Spouse

If you have more than one job or a working spouse, this step ensures accurate withholding.

Option (a) calculates withholding based on all jobs.

Option (b) estimates based on fewer details.

For two jobs with similar pay, use Option (c) by checking the box on both forms, which splits the deduction between jobs but may result in extra withholding if incomes differ significantly.

Step 3: Claim Dependents

Enter eligible dependents and qualifying children under 17 to claim the child tax credit. You can also add other eligible credits, like foreign tax or education credits, which will increase your paycheck by reducing withheld taxes.

Step 4 (Optional Adjustments)

4(a) Other Income: Include other income estimates (not from jobs/self-employment) to avoid estimated tax payments.

4(b) Deductions: Enter itemized deductions or eligible tax reductions to lower withholding if they exceed the standard deduction.

4(c) Additional Withholding: If you want extra tax withheld per paycheck, enter the amount here, which can reduce your tax owed or increase your refund.

By carefully completing each step, you ensure accurate tax withholding tailored to your financial situation.

When is the W-4 form due date?

There's no particular due date for preparing Employee's Withholding Certificate. You should fill out the printable form W-4 when a company first hires you and every time your tax situation changes. It's not necessary to fill it out every tax year. However, it is a good idea because your tax situation may differ since the last W-4 form completion.

Where do I send my printed W-4 form?

Employees should provide a printed W-4 form to their employer, who are no longer required to send these certificates to the IRS. Employers must keep these certificates for each worker on file for at least four years after the employment tax due date or payment. The IRS may request these documents for revision, so make sure original federal W-4 forms are available for inspection. The IRS may also demand copies of these certificates.

Show more

Show less

FAQ

Why are there no withholding allowances on the new IRS Form W-4?

Withholding allowances are no longer part of the redesigned Form W-4. This update aims to improve the form’s transparency, simplicity, and accuracy. Previously, withholding allowances were based on the value of personal exemptions, which are no longer available due to changes in tax law. Therefore, individual and dependency exemptions cannot be claimed on the current Form W-4.

Do all employees need to submit a new Form W-4?

No, employees who submitted a Form W-4 before 2020 are not required to provide a new form solely due to the redesign. Employers will continue to calculate withholding based on the information from each employee's most recently submitted Form W-4.

Why do I need to account for multiple jobs in Step 2?

When you have multiple jobs or a working spouse, additional withholding is needed because tax rates increase with combined income, and only one standard deduction applies. Step 2 on the new IRS W-4 2025 simplifies adjustments to avoid underpayment and potential penalties.

If two jobs pay similarly, or if one job's pay later becomes higher, which Form W-4 should I adjust?

Adjustments on the W-4 for the highest-paying job typically ensure the most accurate withholding. However, if your jobs pay about the same or one job’s pay later exceeds the other, it’s less critical that W-4 is adjusted.

What steps should I follow to fill out tax forms using pdfFiller?

To fill out tax forms with pdfFiller, open the form you need, use the intuitive editing tools to enter your information, and save your changes. You can also use the auto-fill feature for faster completion.

How does pdfFiller ensure the security and privacy of my tax information?

pdfFiller prioritizes your data security with advanced encryption, secure cloud storage, and compliance with key industry standards like GDPR and HIPAA, ensuring your tax information remains private and protected.

What are key features of pdfFiller?

With features like cloud storage, document editing, eSignatures, and easy sharing, pdfFiller is designed to streamline tax document management, saving you time and reducing stress during tax season. Plus, our mobile app allows you to access and edit your documents on-the-go.

What if I have side work as an independent contractor?

If you earn income from self-employment, you’ll owe both income tax and self-employment tax. Form W-4 is designed for employees and doesn’t calculate self-employment tax. To adjust your withholding for self-employment income, use the Tax Withholding Estimator at IRS.gov/w4app or consult IRS Publication 505.

File fillable W-4 2025 online: Try Risk Free & Rate free fillable IRS W-4 tax form

Read user feedback and try pdfFiller to explore all its benefits for yourself

PDFfiller.com is very user friendly and I love it!

Took me a little time to figure out some of the features but got the hang of it. Wish there were more available documents to choose from.

Fill out W-4