Saving and Investing Resources for Native Americans

Having a roadmap to building wealth through investing is important for Native Americans, whether they are starting their first job, nearing retirement, or receiving a lump sum payment. The resources below will help you make informed investing decisions, build wealth over time, and avoid scams.

Lump Sum Benefits

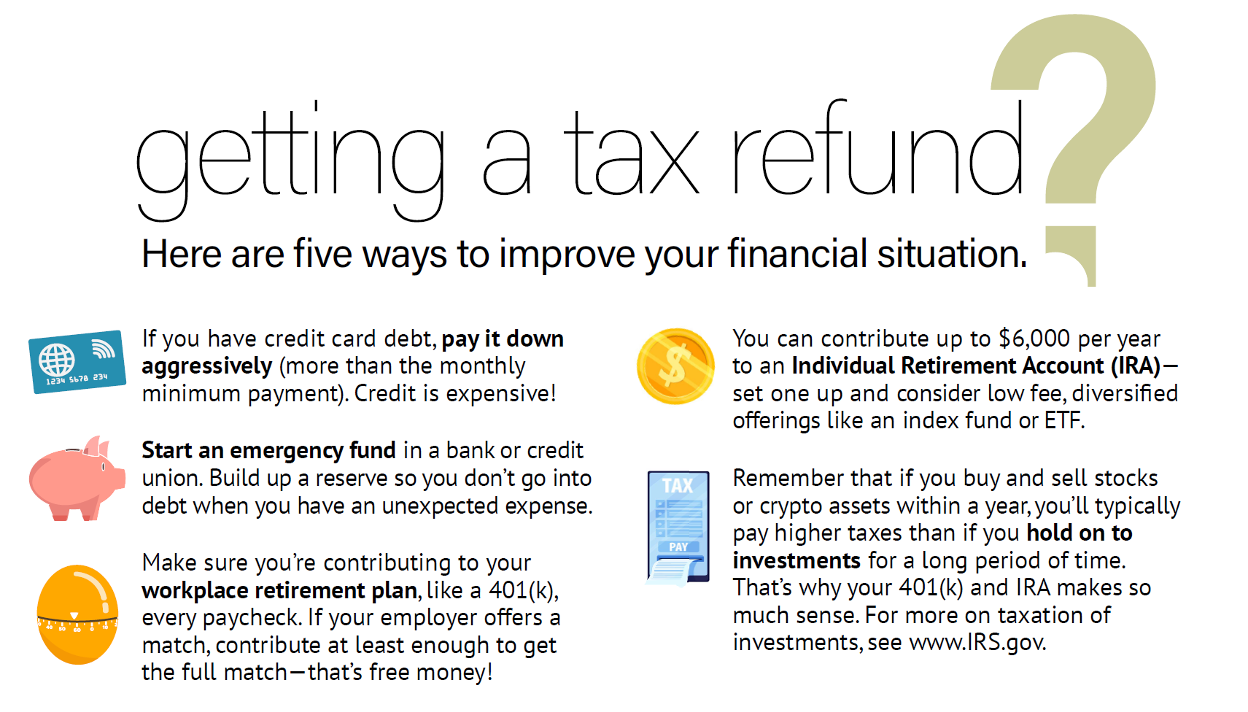

Native Americans may receive one-time lump sum payments, including trust payments, natural resource or casino bonus payments, per capita distributions, or other tribal benefits. These payments can provide along-term improvement to your financial situation, especially if you take steps to reduce debt and bolster savings and investments. Check out our tips to make the most of lump sum payments.

Native Americans may receive one-time lump sum payments, including trust payments, natural resource or casino bonus payments, per capita distributions, or other tribal benefits. These payments can provide along-term improvement to your financial situation, especially if you take steps to reduce debt and bolster savings and investments. Check out our tips to make the most of lump sum payments.

Getting Started

One of the best ways to start building wealth is by contributing a small amount of money to an investment, and then continuing to make contributions over time. That gives you the power of compounding! Many investors begin their wealth journey by taking advantage of workplace retirement plans (sometimes called 401(k)s) or individual retirement accounts (IRAs). Those investments offer tax advantages and, often, diversification. See our Introduction to Investing and the resources below to learn how to begin.

One of the best ways to start building wealth is by contributing a small amount of money to an investment, and then continuing to make contributions over time. That gives you the power of compounding! Many investors begin their wealth journey by taking advantage of workplace retirement plans (sometimes called 401(k)s) or individual retirement accounts (IRAs). Those investments offer tax advantages and, often, diversification. See our Introduction to Investing and the resources below to learn how to begin.

Tools and Calculators

Investor.gov has resources that can help you plan for your financial future, including our tools and calculators below.

Calculate Compound Interest Calculator

See how your invested money can grow over time through the power of compound interest.

Savings Goal Calculator

Calculate how much money you need to save each month to reach a specific goal with our Savings Goal Calculator.

FINRA’s Fund Analyzer

Compare the fees of investment products with FINRA’s Fund Analyzer.

Protect Your Money

Red Flags of Fraud

What You Can Do To Avoid Investment Fraud

Researchers have found that investment fraudsters hit their targets with an array of persuasion techniques that are tailored to the victim's psychological profile. Protect your investments by watching out for these red flags:

- It sounds too good to be true

- "Guaranteed returns" (they don't exist)

- The "halo" effect, which makes con artists seem likable or trustworthy

- "Everyone is buying it" pitches

- Pressure to send money right now

- Small favors (free lunch or workshop)

Protect Your Money

- Watch out for scams that target communities like yours

- What You Can Do To Avoid Investment Fraud

- Identity Theft, Data Breaches and Your Investment Accounts

- Social Media and Investment Fraud

- Exercise Caution With Crypto Assets

- Say “No” to FOMO

- Unsolicited Investment Pitches: Don’t Answer! Hang up! Delete!