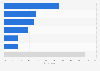

Pre-Christmas sales retail spending and growth forecast Australia 2024, by category

Australian consumers geared up for a robust pre-Christmas shopping season in 2024. Total expenditures were forecast to reach almost 70 billion Australian dollars, marking a 2.7 percent increase from 2023’s pre-Christmas sales expectations. The food category was anticipated to lead the way with projected spending of around 28 billion dollars, followed by the household goods segment. Conversely, department stores were expected to bring in the lowest spending, contracting by around 1.5 percent from the previous year.

Holiday season sales: just for celebrations or a chance to stock up?

Australia’s shoppers are increasingly aware of and participating in various sales events to capitalize on bargain gifts for their loved ones and festive food in the run-up to Christmas. Not only are they in the festive spirit, but they are harnessing discounts to stock up on essentials amid cost-of-living pressures. During the 2024 Black Friday and Cyber Monday sales, Australians were set to spend a record-breaking 6.7 billion Australian dollars, up by about 5.5 percent from 2023’s forecast for the four-day promotional period. While Black Friday takes the reins during the holiday season sales, post-Christmas sales events like Boxing Day also provide retailers with an end-of-year revenue boost and a chance to clear inventory before the New Year.

Where are Australians making their festive purchases?

As the holiday season approaches, Australian consumers increasingly turn to online platforms for their Christmas shopping needs. In a July 2024 survey, nearly 70 percent of respondents planned to purchase gifts from online marketplaces such as Amazon and eBay. This shift towards e-commerce is further supported by the convenience it offers, with around one-fifth of consumers citing avoiding the in-store holiday rush as a key benefit of online shopping during the festive period. Nevertheless, in-store shopping experiences remain valuable. The ability to see and touch products remains the primary reason for conducting Christmas shopping in physical stores, with around 40 percent of surveyed consumers valuing this aspect, alongside getting inspiration for gifts and avoiding shipping costs. This preference for shopping in brick-and-mortar locations is particularly strong in certain categories, such as festive food.