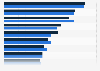

Net loss ratio of P/C insurance in the U.S. 2014-2023

During the nine-year period from 2014 through to 2023, the net loss ratio of property/casualty insurance increased. In 2014 and 2015, the net loss ratio rested at roughly 69 percent, reaching above 70 percent by 2016. In 2022, a high of 76.4 percent was reached, with the p/c net loss ratio having rested at 76.2 percent as of 2023.

Property and casualty insurance

General insurance, known as property and casualty insurance in the United States, covers non-life insurance policies. It covers property that is at risk of damage. Some policies include homeowners insurance, car insurance, condo insurance, renters insurance, and landlord insurance. For homeowners insurance, it is utilized when an individual suffers on a property as a result of the owner’s negligence. The homeowners' insurance would cover the medical fees if the victim had to go to the hospital. If the victim decided to sue, the homeowners' insurance would cover the legal fees. It is also utilized when there is damage to the home as a result of vandalism or theft. Furthermore, it is also used when there is damage caused by extreme weather.

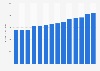

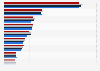

Insurance companies

The leading mutual property and casualty insurance company in the United States is State Farm in terms of revenue. Since 2010, the direct premiums written by the property and casualty insurance industry in the United States have been rising.