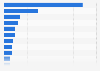

Islamic banking assets globally 2022, by region

Islamic banking assets in the Gulf Cooperation Council region amounted to 1,345 billion U.S. dollars in 2022. The value of Islamic banking assets has consistently increased in the last couple of years.

Islamic Banking

The Islamic banking sector arose in the 1960s as an alternative to conventional banking to operate in accordance with Islamic law. The main Islamic principle of Islamic banks is to have a business model which avoids taking riba, that is to profit from interest or usury. Islamic banks use the Emirates Interbank Offered Rate (EIBOR), avoid high risk taking and divide the usual financial risk equally between all parties as well as share profits and loss of enterprises they underwrite. They offer products such as musharakah (joint ventures), lease-to-own financing, Murabaha (installment sale with profit), Ijara (leasing) and Islamic forward products. The banking division was the leading branch of the Islamic finance sector.

Iran led the sector with over 488 billion U.S. dollars in value of Islamic banking assets. As of 2019, CIMB Group from Malaysia was the fastest growing Islamic finance enterprise among banks with more than 25 billion U.S. dollars in Sharia compliance assets.

Islamic Banking

The Islamic banking sector arose in the 1960s as an alternative to conventional banking to operate in accordance with Islamic law. The main Islamic principle of Islamic banks is to have a business model which avoids taking riba, that is to profit from interest or usury. Islamic banks use the Emirates Interbank Offered Rate (EIBOR), avoid high risk taking and divide the usual financial risk equally between all parties as well as share profits and loss of enterprises they underwrite. They offer products such as musharakah (joint ventures), lease-to-own financing, Murabaha (installment sale with profit), Ijara (leasing) and Islamic forward products. The banking division was the leading branch of the Islamic finance sector.

Iran led the sector with over 488 billion U.S. dollars in value of Islamic banking assets. As of 2019, CIMB Group from Malaysia was the fastest growing Islamic finance enterprise among banks with more than 25 billion U.S. dollars in Sharia compliance assets.