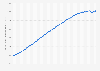

Average student debt of university graduates in the Netherlands 2006-2016

How high is the average student debt in the Netherlands? In 2016, a university (in Dutch: WO) graduate had a debt of around 10,700 euros. Newer numbers were not available, as the national system for student loans changed in 2015. In 2015-2016, the so-called basisbeurs (a conditional loan a student would receive in the Netherlands, which would turn into a gift when he/she graduated within ten years) was abolished. This currently means that if students need more money, they must loan it from the government. In 2017, the Dutch government granted 2.4 billion euros worth of loans to students.

University graduates had a higher chance of a student debt

The total student debt in the Netherlands was worth 11.2 billion euros in 2017. Roughly six out of ten research university graduates had a student debt. This was significantly higher than university of applied sciences graduates (in Dutch: HBO), of which 33 percent had a student debt.

Student debts influence house purchases in the Netherlands

In 2017, approximately 16 percent of all first-time homebuyers in the Netherlands consisted of the age group between 25 and 29 years old. This was a decrease from the approximately 25 percent in 2013. As (student) debts and personal income count towards mortgage requests and partly determine whether or not mortgage providers are willing to lend money for the purchase of a house, an increasing student debt made it more difficult for starters in the Netherlands to enter the real estate market. Mortgages are the most common way to finance real estate for households in the Netherlands.

University graduates had a higher chance of a student debt

The total student debt in the Netherlands was worth 11.2 billion euros in 2017. Roughly six out of ten research university graduates had a student debt. This was significantly higher than university of applied sciences graduates (in Dutch: HBO), of which 33 percent had a student debt.

Student debts influence house purchases in the Netherlands

In 2017, approximately 16 percent of all first-time homebuyers in the Netherlands consisted of the age group between 25 and 29 years old. This was a decrease from the approximately 25 percent in 2013. As (student) debts and personal income count towards mortgage requests and partly determine whether or not mortgage providers are willing to lend money for the purchase of a house, an increasing student debt made it more difficult for starters in the Netherlands to enter the real estate market. Mortgages are the most common way to finance real estate for households in the Netherlands.