Pet insurance in the United Kingdom - statistics & facts

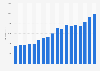

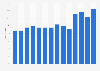

Owning a pet is not all cuddles, cuteness and video uploads of your dog onto YouTube, though. There are a few "small" costs to think about, such as pet insurance. In 2016, gross written premiums in the UK pet insurance industry amounted to over one billion British pounds. In the same year nearly 50 percent of the British public believed the lifetime cost of owning a dog would be between one thousand and five thousand pounds. In reality, the actual expense ended up being closer to 27 thousand British pounds.

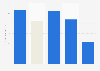

Veterinary costs and pet services alone can be extremely high, with consumer spending in the UK reaching nearly 4.2 billion British pounds in 2017. One way of limiting these unexpected costs while still ensuring your pets well-being is through setting up pet insurance. Although pet insurance companies pay out approximately 1.9 million British pounds per day in claims, the scary fact is that most pet owners do not have insurance to cover their extended family members. Of those that do, their priorities lie with dogs and cats, with the two species attributable for 97 percent of all insured pets in the UK.

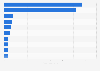

Insurance costs for dogs vary far more than those for cats and the list of factors that effect premiums is staggering. Insurance companies take into consideration breed, age, size and policy type to name just a few criteria. Let's take the English Bulldog for example, which would set its owner back with monthly insurance costs of over 134 British pounds, compared to a Cocker Spaniel, which has a monthly insurance premium of closer to 37 pounds.