Regulatory Announcements

What is e-Invoice?

General

- What is e-Invoice?

An e-Invoice is a digital representation of a transaction between a supplier and a buyer, formatted in a structured, machine-readable manner. It is a file created in the format specified by the IRBM (i.e., in XML or JSON file format) and not in the form of PDF, JPG etc. It contains the same essential information as a traditional document, for example, supplier’s and buyer’s details, item description, quantity, price excluding tax, tax amount and total amount, which record transaction data for daily business operations.

The principles of when e-Invoice is to be issued would be as follow:

- Proof of income: Whenever a sale or other transaction is made to recognise income of taxpayers;

- Proof of expense: This covers purchases made or other spending by taxpayers.

Below is the e-Invoice implementation timeline:

|

Implementation Date |

| Taxpayers with an annual turnover or revenue of more than RM100 million | 1 August 2024 |

| Taxpayers with an annual turnover or revenue of more than RM25 million and up to RM100 million | 1 January 2025 |

| All other taxpayers | 1 July 2025 |

For more information, please refer to IRBM’s official website - e-Invoice | Lembaga Hasil Dalam Negeri Malaysia and FAQ specific to Financial Industry specific-faq-financial-services-stockbroking-and-unit-trust.pdf (hasil.gov.my).

- When will the Bank begin issuing e-invoice to customers?

The full implementation of e-Invoice by the Bank will be by 1 July 2025. Prior to 1 July 2025, the Bank will not be providing e-Invoice to customers.

Wholesale Banking & Retail

| No | Question | Non-Individual | Individual |

|

|

When is the effective date that the Bank will start implementing e-Invoice? |

UOBM will fully implement e-Invoice by 1 July 2025 in accordance with the current legislations. However, this will only be made available to parties who have provided complete e-Invoice data including their Taxpayer Identification Number (TIN) and Sales and Service Tax (SST) details to UOBM where applicable. |

UOBM will fully implement e-Invoice by 1 July 2025 in accordance with the current legislations. For those who would like to have a copy of the e-Invoice, please contact or visit our nearest branch from 1 July 2025 onwards. However, this will only be made available to parties who have provided complete e-Invoice data including their Taxpayer Identification Number (TIN) to UOBM. Exemptions: To refer to the Inland Revenue Board of Malaysia (IRBM)’s e-Invoice Guideline for the complete list of exemptions. https://www.hasil.gov.my/en/e-invoice/guidelines/ |

|

|

Are customers required to provide details to UOBM for the issuance of e-Invoice? |

UOBM will soon begin the collection of required information from our customers for e-Invoice submission. Further details on the collection methods and schedule will be shared soon. |

It is not mandatory for the customer to request for an e-Invoice document. However, if the customer does require an e-Invoice document, the customer must provide his/her accurate details (e.g. TIN) to UOBM to facilitate the issuance of the e-Invoice document. Please note that UOBM cannot compel customers to provide their TIN details and it is the customers' responsibility to comply with the IRBM's e-Invoice regulations. |

|

|

|

|

|

|

|

Please refer to https://www.hasil.gov.my/en/individual/individual-lifecycle/registration/ or https://www.hasil.gov.my/en/company/tax-file-registration/ for further information. |

|

|

|

How does the Bank deliver the e-Invoice to customers? |

The Bank is obliged to issue e-Invoice(s) for all resident & non-resident entities, whenever applicable and the validated e-Invoice(s) will be delivered to your mailing address maintained with the Bank. |

e-Invoice will be delivered to your email address registered with the Bank upon request. |

|

|

How long does it take for an e-Invoice to be issued by UOBM? | The frequency of the e-Invoice document will match your existing statement cycle or on a transactional basis. |

For most banking products, UOBM will issue an e-Invoice with each corresponding account statement. The frequency of the e-Invoice document will match your existing statement cycle. For one-time/ad-hoc transaction(s), the e-Invoice document will be issued after the transaction is completed. |

|

|

How can I enroll for e-Invoice for my banking products? |

No enrollment or registration is required for receiving e-Invoice. |

No enrollment is required. It is not mandatory for customer to request for e-Invoice document. However, if the customer requires an e-Invoice document, the customer must provide complete e-Invoice data including their Taxpayer Identification Number (TIN) to UOBM to facilitate the issuance of the e-Invoice document. |

|

|

Which banking products support e-Invoice? |

Please refer to Industry Specific Frequently Asked Question for Financial Service, Stockbroking, and Unit Trust for more information. specific-faq-financial-services-stockbroking-and-unit-trust.pdf |

For most of banking products, UOBM will issue e-Invoice document with each corresponding account statement. |

|

|

What would happen if the customer provided incorrect/incomplete e-Invoice information to UOBM? |

For UOBM to generate the e-Invoice document, customers must provide complete and accurate information. UOBM cannot issue the e-Invoice document until the missing details are provided. Customers are responsible for ensuring the accuracy and correctness of all data and information provided. For the full implementation of e-Invoice on 1 July 2025, UOBM will provide updates from time-to-time on our enhanced digital services which will allow customers to submit their e-Invoice related details seamlessly. |

For UOBM to generate the e-Invoice document, customers must provide complete and accurate information. UOBM cannot issue the e-Invoice document until the missing details are provided. Customers are responsible for ensuring the accuracy and correctness of all data and information provided. For the full implementation of e-Invoice on 1 July 2025, UOBM will provide updates from time-to-time on our enhanced digital services which will allow customers to submit their e-Invoice related details seamlessly. |

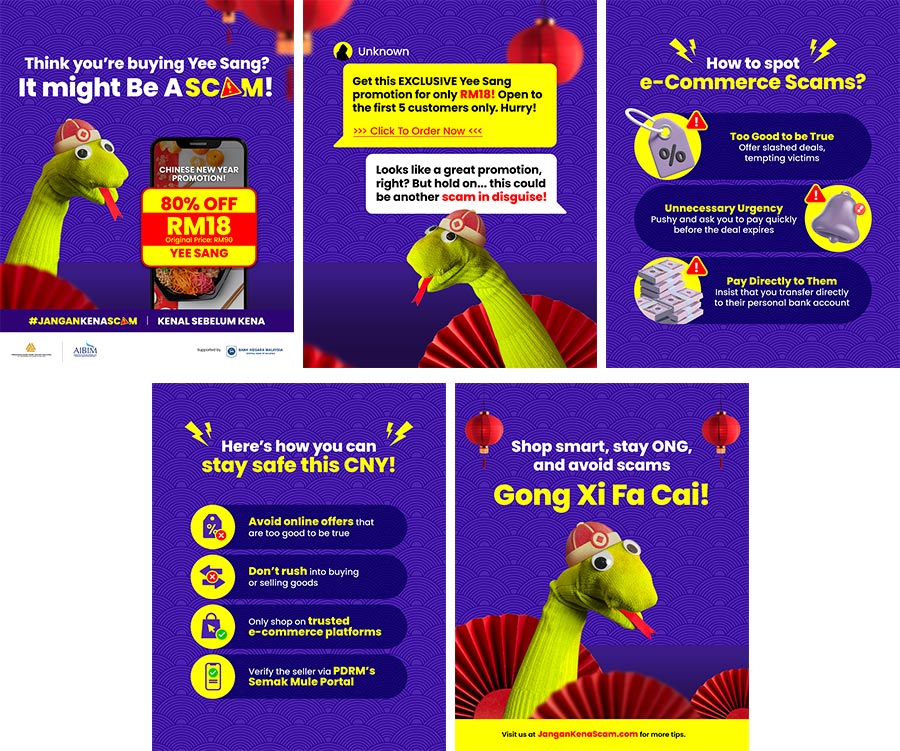

Don’t fall for deals that are too good to be true!

Scored what seemed like the best CNY deals? Remember, scammers are always looking for their next victims. Stay sharp and think twice before you shop to avoid e-commerce scams.

If you’ve been scammed, immediately call 03-2612 8100 or the National Scam Response Centre at 997 (8am-8pm daily) and make a police report.

#JanganKenaScam

Waspada dengan scam malware ketika membeli-belah di musim CNY!

Musim perayaan telah tiba! Berhati-hati ketika mencari tawaran di media sosial dan jangan muat turun sebarang fail .APK. Ingat, jika tawaran terlalu menarik, ia mungkin adalah scam. Kekal waspada untuk lindungi wang anda!

Jika terkena scam, segera hubungi 03-2612 8100 atau Pusat Respons Scam Kebangsaan di 997 (8am - 8pm, setiap hari) dan buat laporan polis.

#JanganKenaScam

提防恶意软件诈骗, 购年货时才不会受骗!

每逢佳节来临,骗子也会趁机出没!所以在社交媒体或网站上购年货时,千万不要乱下载任何.APK软件。如果遇到更好但却不切实际的优惠时 ,也不要轻易上当。时刻提防,保护好自己的钱财!

如果你不幸掉入诈骗陷阱,请立马联系 03-2612 8100 或国家诈骗应对中心热线 :997 (每日 8am-8pm)并报警。

#JanganKenaScam

Watch out for malware scams while shopping online this CNY!

The festive season is here, and so are sneaky scammers! Be extra cautious when browsing deals on social media and do not download any .APK file. If it looks too good to be true, it probably is. Stay alert and protect your money.

If you’ve been scammed, immediately call 03-2612 8100 or the National Scam Response Centre at 997 (8am-8pm daily) and make a police report.

#JanganKenaScam

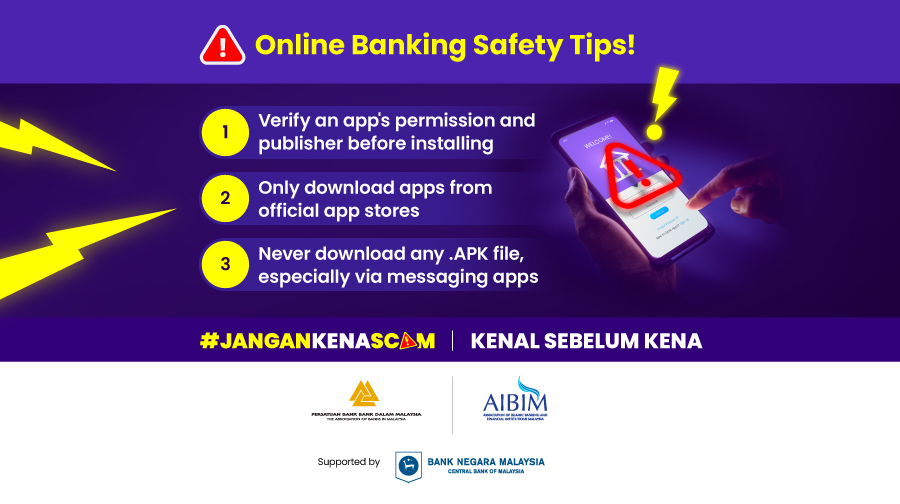

Don't let scammers get in between you and your online banking!

Stay safe with these simple steps to keep your online banking experience stress-free. Never back down to scammers!

If you’ve been scammed, immediately call 03-2612 8100 or the National Scam Response Centre at 997 (8am-8pm daily) and make a police report.

#JanganKenaScam

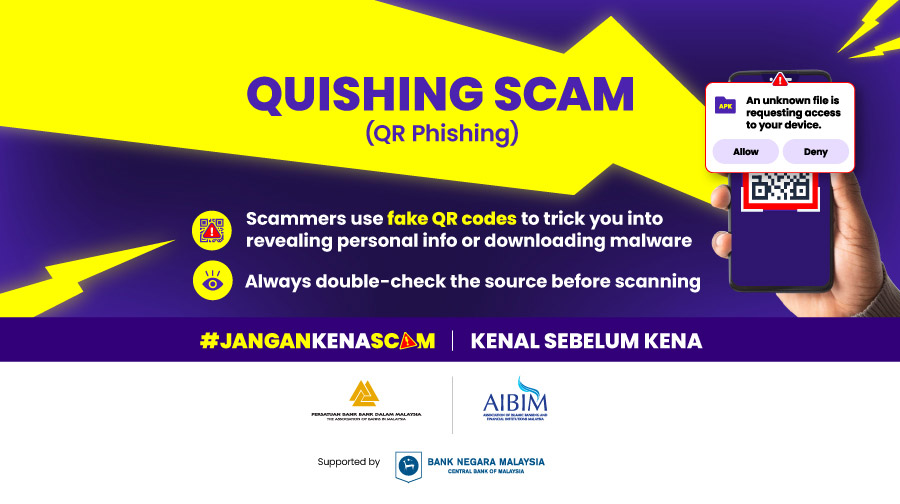

Be careful before scanning any QR codes to avoid being scammed!

Scammers are targeting you with Quishing scams! Always verify the source and the destination link before scanning. Stay alert and protect your information from these scammers!

If you’ve been scammed, immediately call 03-2612 8100 or the National Scam Response Centre at 997 (8am-8pm daily) and make a police report.

#JanganKenaScam

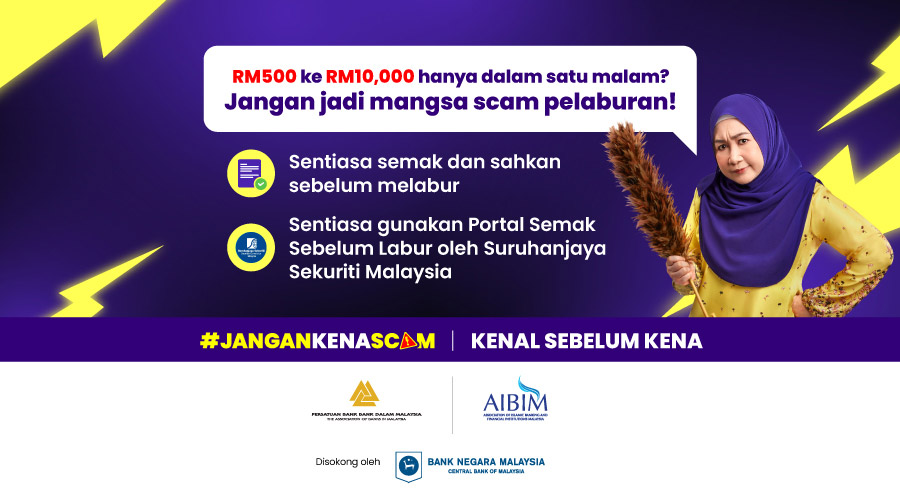

Semak dan sahkan sebelum melabur!

Tawaran pelaburan memang nampak menarik, tapi tak berbaloi kalau kita jadi mangsa scam! Sentiasa semak kesahihan skim pelaburan/syarikat pelaburan dahulu sebelum melabur.

Jika terkena scam, segera hubungi talian khas bank anda atau Pusat Respons Scam Kebangsaan di 997 (8am - 8pm, setiap hari) dan buat laporan polis.

#JanganKenaScam

#KenalSebelumKena

E-Invoicing Implementation: Required information of UOB entities.

To whom it may concern,

In line with the implementation of e-Invoicing in Malaysia, please refer to the following required information of UOB entities for e-invoice purposes: -

| Name of Entities | Tax Identification Number (TIN) | New Business Registration Number (BRN) | Service Tax Registration Number (SST) | Malaysian Standard Industrial Classification (MSIC) |

| United Overseas Bank (Malaysia) Bhd | C 5864781030 | 199301017069 | W10-1808-32001529 | 64191 |

| UOBM Nominees (Tempatan) Sdn Bhd | C 868255000 | 197301001860 | N/A | 64993 |

| UOB Properties Bhd | C 5868573010 | 199401009730 | N/A | 68109 |

| UOB Properties (KL) Bhd | C 861170100 | 196901000585 | W10-2301-32000077 | 68104 |

Please be informed that we will not provide source documents for verification purposes, and the information stated above on this website is to be considered as a formal response.

For contact information related to e-Invoicing, such as buyer address, email, and phone number, please state the details of the relevant point-of-contact in relation to the procurement of the goods or services.

Please take note that vendors shall continue to send a copy of vendor invoices to your respective UOB entities’ point-of-contact to ensure uninterrupted business operations and timely payments.

Thank you.

Research and verify before investing!

The offer may be tempting, but it is not worth the risk of becoming a victim of such a scam. Always remember to do your research and verify with official sources before investing.

If you’ve been scammed, immediately call 03-2612 8100 or the National Scam Response Centre at 997 (8am-8pm daily) and make a police report.

#JanganKenaScam

Kena scam? Jangan panik, selamatkan akaun anda segera!

Jika terkena scam, segera aktifkan fungsi ‘kill switch’ di aplikasi perbankan anda untuk hentikan transaksi. Hubungi NSRCdi 997 atau talian khas bank anda, dan buat laporan polis untuk tindakan lanjut. Jangan biarkan scammer menang!

Jika terkena scam, segera hubungi 03-2612 8100 atau Pusat Respons Scam Kebangsaan di 997 (8am - 8pm, setiap hari) dan buat laporan polis.

#JanganKenaScam

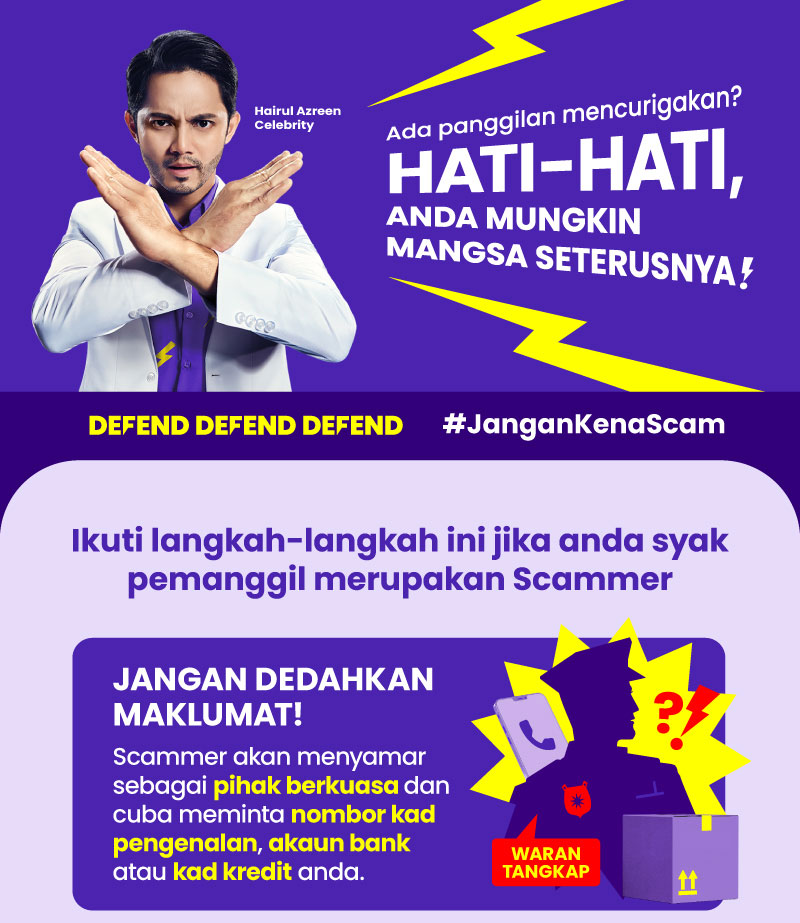

Hati-hati dengan panggilan yang mengugut atau menuduh anda!

Jangan panik. Scammer banyak menyamar jadi pihak berkuasa. Jadi, sentiasa semak dahulu dengan talian rasmi pihak berkaitan!

Jika terkena scam, segera hubungi 03-2612 8100 atau Pusat Respons Scam Kebangsaan di 997 (8am - 8pm, setiap hari) dan buat laporan polis.

#JanganKenaScam

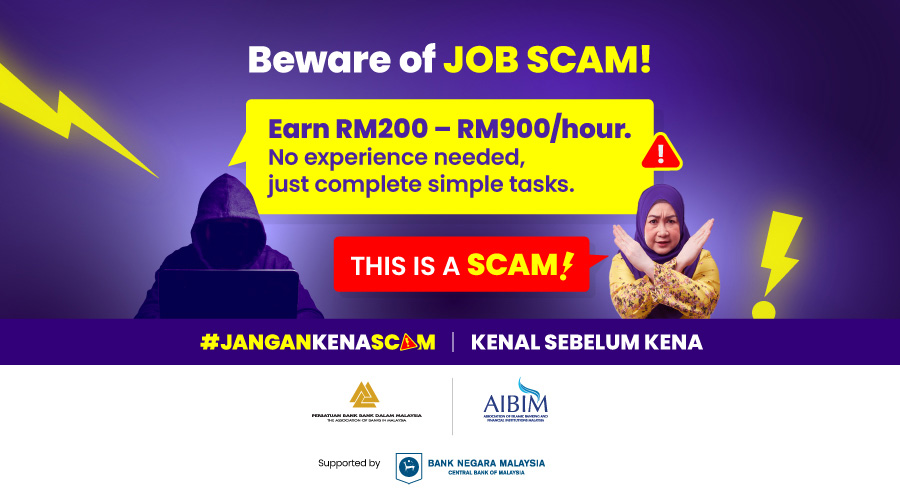

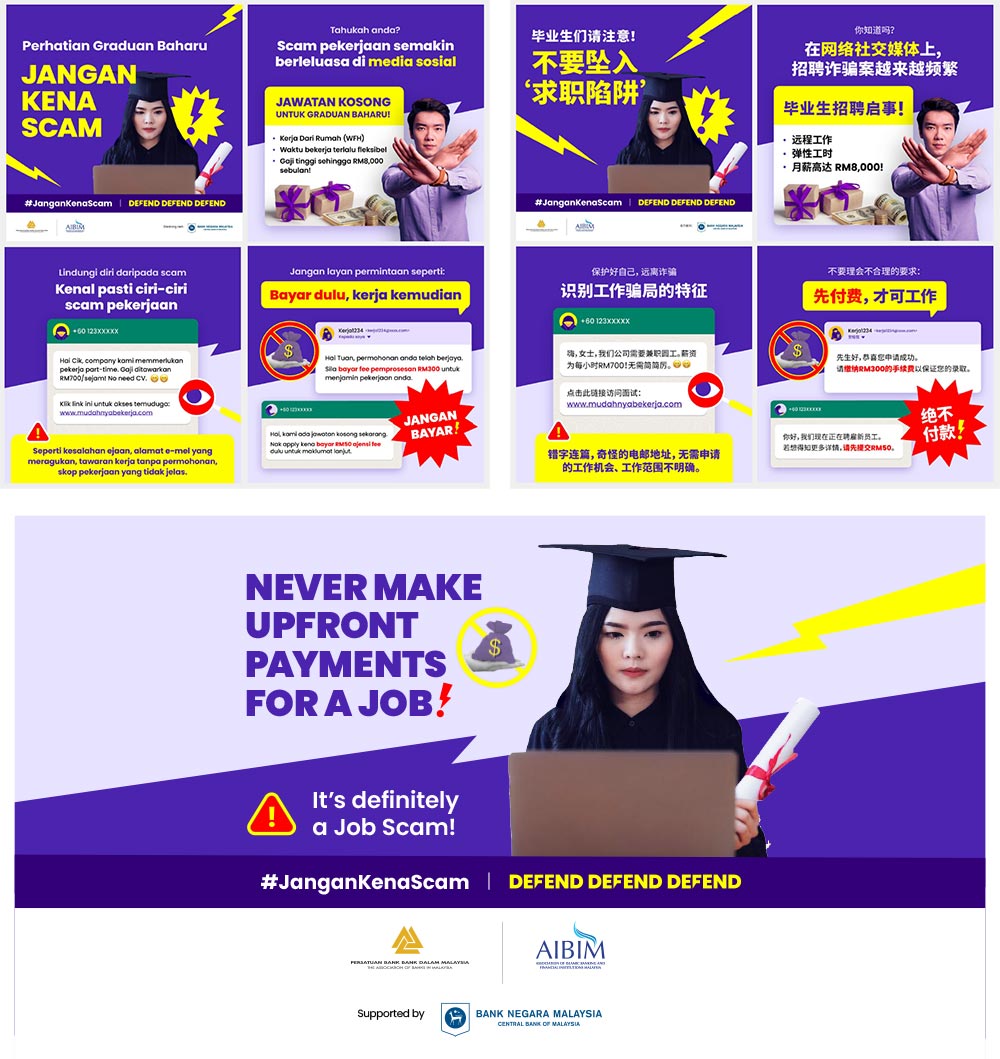

Job Offer Requires You to Pay? It’s a Scam!

High pay, simple tasks, but you're asked to pay first? It's a scam tactic! Remember, legitimate companies will never ask for your money.

If you’ve been scammed, immediately call 03-2612 8100 or the National Scam Response Centre at 997 (8am-8pm daily) and make a police report.

#JanganKenaScam

Don’t Let Fake Travel Deals Ruin Your Trip!

Ready to book your vacation? Verify the website and seller before making payment, and beware of offers that seem too good to be true.

If you’ve been scammed, immediately call 03-2612 8100 or the National Scam Response Centre at 997 (8am-8pm daily) and make a police report.

#JanganKenaScam

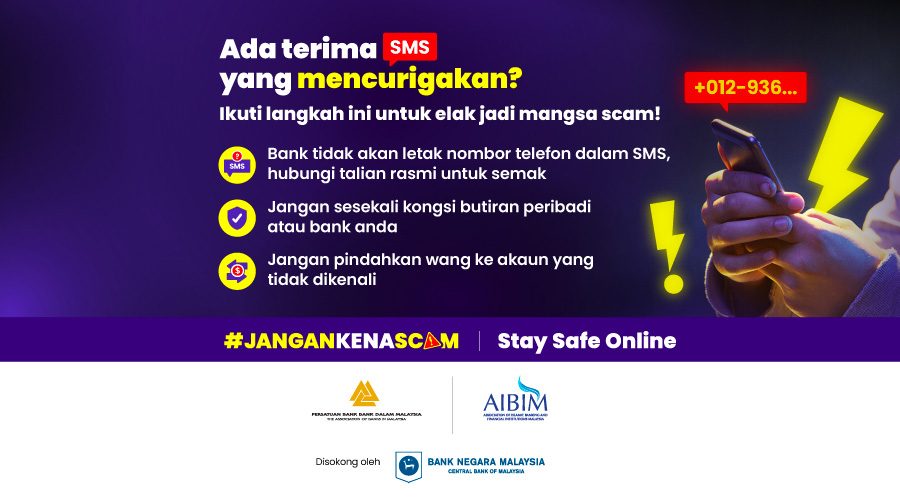

Jangan terpedaya dengan SMS bank Palsu!

Terima SMS mencurigakan daripada 'bank'? Jangan terpedaya! Bank tidak akan sertakan nombor telefon dalam SMS. Pastikan anda hubungi talian rasmi bank anda untuk pengesahan.

Jika terkena scam, segera hubungi 03-2612 8100 atau Pusat Respons Scam Kebangsaan di 997 (8am - 8pm, setiap hari) dan buat laporan polis.

#JanganKenaScam

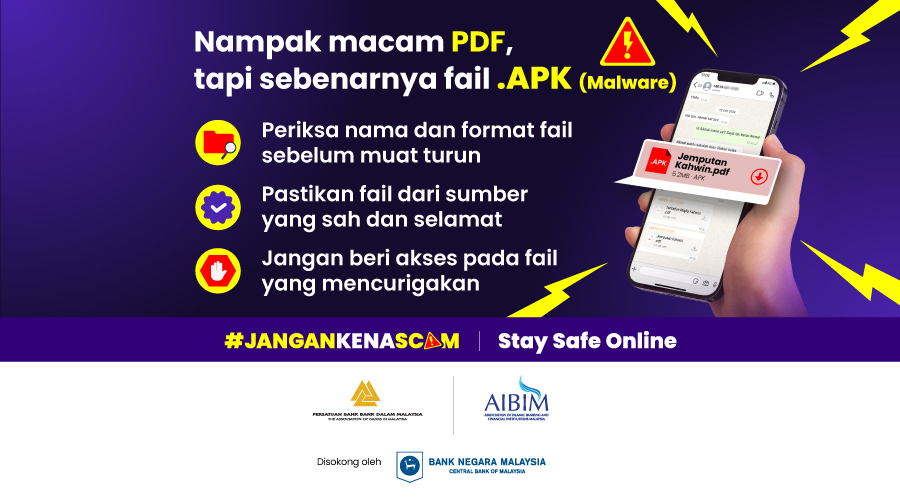

Elakkan Jadi Mangsa Scam Malware! Jangan muat turun fail .APK sembarangan.

Sentiasa semak fail yang diterima. Jangan muat turun dan beri akses pada fail mencurigakan!

Jika terkena scam, segera hubungi 03-2612 8100 atau Pusat Respons Scam Kebangsaan di 997 (8am - 8pm, setiap hari) dan buat laporan polis.

#JanganKenaScam

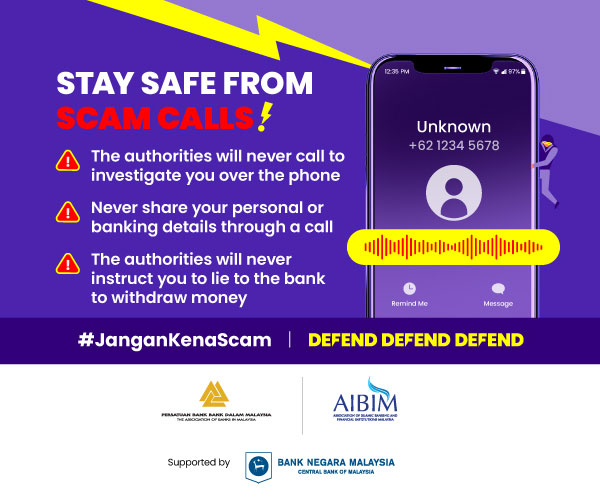

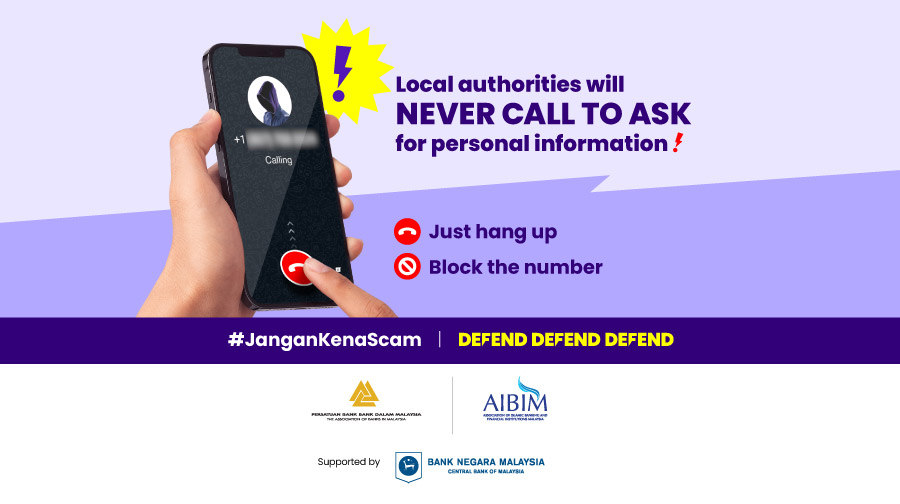

Never share your banking details over the phone!

Always remember that local authorities will never call you for any banking details.

If you’ve been scammed, immediately call 03-2612 8100 or the National Scam Response Centre at 997 (8am-8pm daily) and make a police report.

#JanganKenaScam

Stay alert whenever you make any payment via QR

Report immediately if you notice anything suspicious when making a QR payment!

If you’ve been scammed, immediately call 03-2612 8100 or the National Scam Response Centre at 997 (8am-8pm daily) and make a police report.

#JanganKenaScam

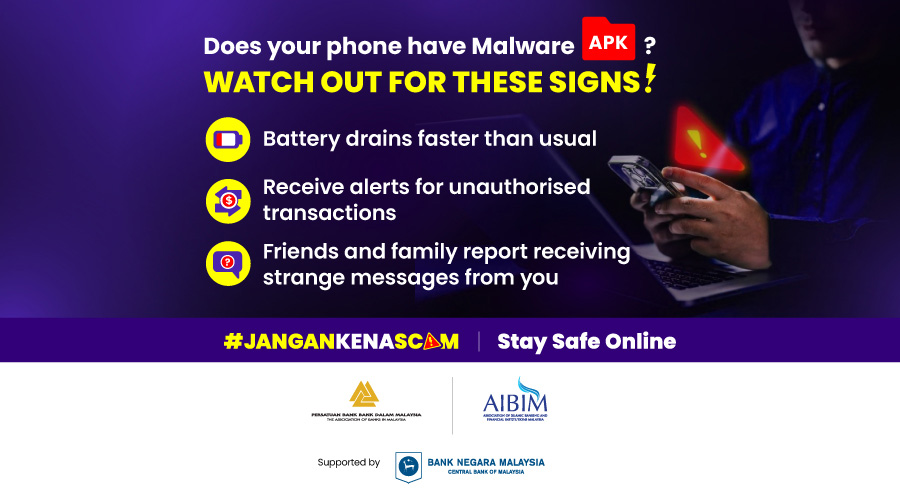

Stay vigilant and learn to detect signs of malware on your phone!

If you detect any signs, find and delete the unauthorised app immediately!

If you’ve been scammed, immediately call 03-2612 8100 or the National Scam Response Centre at 997 (8am-8pm daily) and make a police report.

#JanganKenaScam

Received a weird DM from a stranger? Just block and report!

Never click on suspicious links, it's very likely a phishing scam!

If you’ve been scammed, immediately call 03-2612 8100 or the National Scam Response Centre at 997 (8am-8pm daily) and make a police report. #JanganKenaScam

Got a call accusing you of a crime? Stay calm, it’s a scam!

The authorities will never call to accuse you of a crime you didn't do!

If you’ve been scammed, immediately call 03-2612 8100 or the National Scam Response Centre at 997 (8am-8pm daily) and make a police report. #JanganKenaScam

Jangan mudah terpedaya dengan panggilan dan mesej mencurigakan.

Berhati-hati dengan panggilan dan mesej yang minta maklumat peribadi.

Jika terkena scam, segera hubungi 03-2612 8100 atau Pusat Respons Scam Kebangsaan di 997 (8am - 8pm, setiap hari) dan buat laporan polis. #JanganKenaScam

Stay vigilant online to avoid falling victim to scams!

Be cautious of apps or websites asking for your personal information.

If you’ve been scammed, immediately call 03-2612 8100 or the National Scam Response Centre at 997 (8am-8pm daily) and make a police report. #JanganKenaScam

Always stay calm when you receive a suspicious call!

Suspecting it's a scam call? Just hang up immediately!

If you’ve been scammed, immediately call 03-2612 8100 or the National Scam Response Centre at 997 (8am-8pm daily) and make a police report. #JanganKenaScam

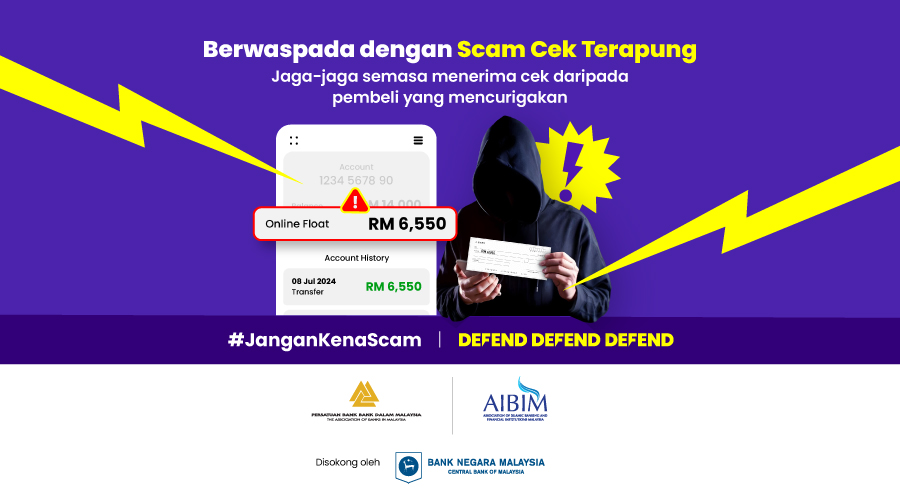

Waspada dengan scammer semasa berniaga secara dalam talian!

Jaga-jaga semasa menerima cek daripada pembeli yang mencurigakan.

Jika terkena scam, segera hubungi 03-2612 8100 atau Pusat Respons Scam Kebangsaan di 997 (8am - 8pm, setiap hari) dan buat laporan polis. #JanganKenaScam

Never scan suspicious QR codes. They are likely phishing scams!

Always beware of unsolicited QR codes from unknown sources.

If you’ve been scammed, immediately call 03-2612 8100 or the National Scam Response Centre at 997 (8am-8pm daily) and make a police report. #JanganKenaScam

Never share the answers to your online banking security questions.

Scammers could use them to reset your online banking password!

If you’ve been scammed, immediately call 03-2612 8100 or the National Scam Response Centre at 997 (8am-8pm daily) and make a police report. #JanganKenaScam

Fresh grads, never accept jobs that ask for upfront payment!

It's a scam! Remember, real jobs pay you, not the other way around.

If you’ve been scammed, immediately call 03-2612 8100 or the National Scam Response Centre at 997 (8am-8pm daily) and make a police report. #JanganKenaScam

Got accused of a crime you didn't commit via a call? Don't worry!

Just ignore them, hang up and report their number to the authorities!

If you’ve been scammed, immediately call 03-2612 8100 or the National Scam Response Centre at 997 (8am-8pm daily) and make a police report. #JanganKenaScam

Do not engage with AI videos made by scammers!

Remember to always verify with official sources to avoid scams.

If you’ve been scammed, immediately call 03-2612 8100 or the National Scam Response Centre at 997 (8am-8pm daily) and make a police report. #JanganKenaScam

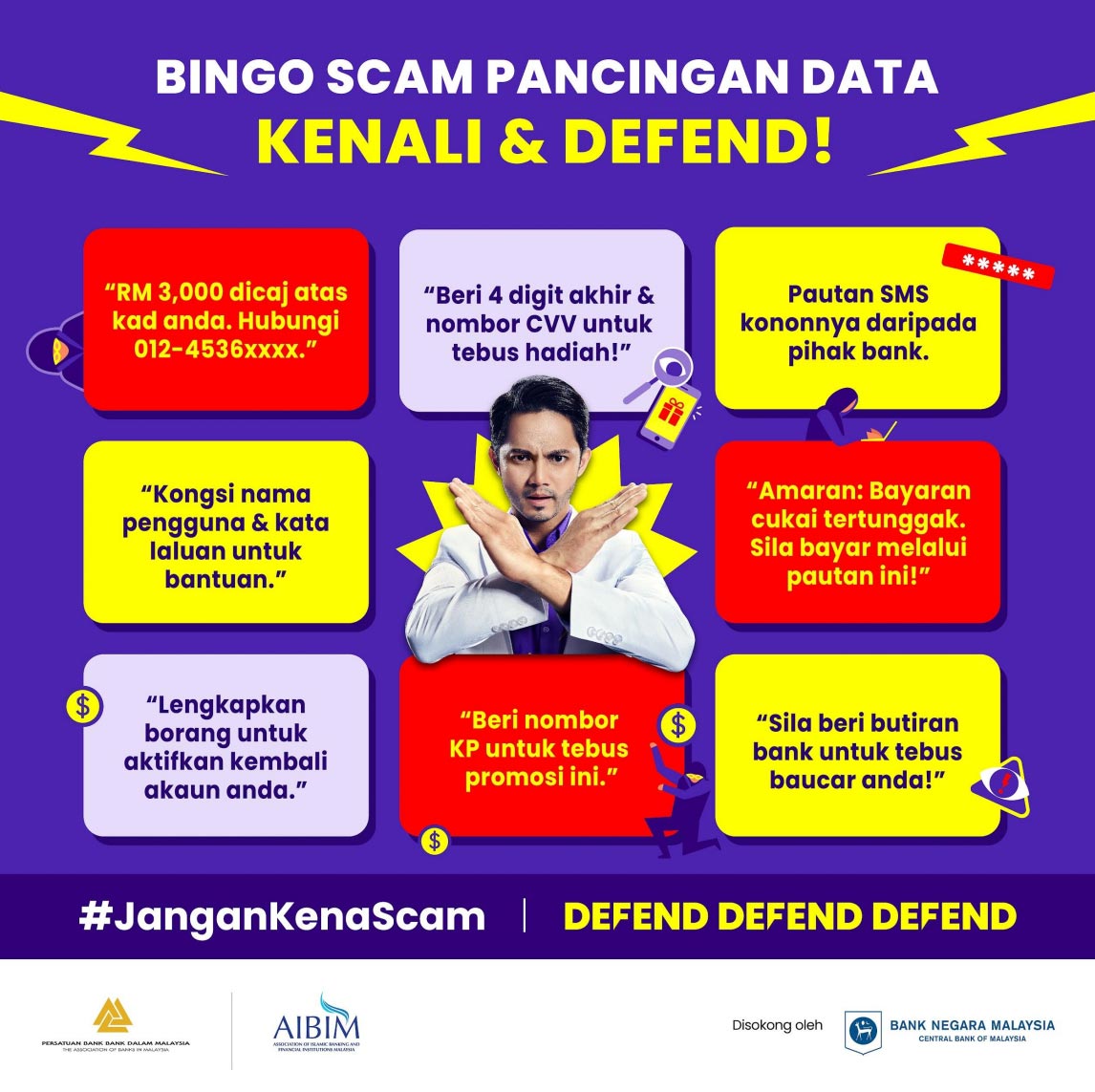

Ini adalah cara terbaik untuk mengatasi scam pancingan data!

Semak pautan laman web sebelum meneruskan aktiviti perbankan.

Jika terkena scam, segera hubungi 03-2612 8100 atau Pusat Respons Scam Kebangsaan di 997 (8am - 8pm, setiap hari) dan buat laporan polis. #JanganKenaScam

Beware of scam calls using fear tactics to trick you!

Never share your personal information or banking details over a call.

If you’ve been scammed, immediately call 03-2612 8100 or the National Scam Response Centre at 997 (8am-8pm daily) and make a police report. #JanganKenaScam

Beware of Malware threats on Android devices!

If you’ve been scammed, immediately call UOB’s 24/7 Fraud hotline at 03-2612 8100 or the National Scam Response Centre at 997 (8am-8pm daily) and make a police report.

Got older relatives who are investing online?

Educate them to always do thorough research before investing!

If you’ve been scammed, immediately call UOB’s 24/7 Fraud hotline at 03-2612 8100 or the National Scam Response Centre at 997 (8am-8pm daily) and make a police report.

As Raya approaches, malware scams will also be on the rise. Be vigilant and stay safe!

If you’ve been scammed, immediately call UOB’s 24/7 Fraud hotline at 03-2612 8100 or the National Scam Response Centre at 997 (8am-8pm daily) and make a police report.

Beware of calls claiming to be from the authorities!

Never reveal personal details and always verify with official sources. If you’ve been scammed, immediately call UOB’s 24/7 Fraud hotline at 03-2612 8100 or the National Scam Response Centre at 997 (8am-8pm daily) and make a police report. #JanganKenaScam

Telltale signs of phishing scams you need to know

Never entertain unsolicited messages or click on unknown links! If you’ve been scammed, immediately call UOB’s 24/7 Fraud hotline at 03-2612 8100 or the National Scam Response Centre at 997 (8am-8pm daily) and make a police report. #JanganKenaScam

Beware of these job scam tactics to stay safe while job-hunting.

Remember to always research the companies you're applying to. If you’ve been scammed, immediately call UOB’s 24/7 Fraud hotline at 03-2612 8100 or the National Scam Response Centre at 997 (8am-8pm daily) and make a police report. #JanganKenaScam

Learn how to protect yourself from malware scams.

Always remember to only download apps from the official app store! If you’ve been scammed, immediately call UOB’s 24/7 Fraud hotline at 03-2612 8100 or the National Scam Response Centre at 997 (8am-8pm daily) and make a police report. #JanganKenaScam

Be careful not to fall for love scams.

Always practise caution when talking to strangers online! If you’ve been scammed, immediately call UOB’s 24/7 Fraud hotline at 03-2612 8100 or the National Scam Response Centre at 997 (8am-8pm daily) and make a police report. #JanganKenaScam

Celebrate Chinese New Year by going GREEN

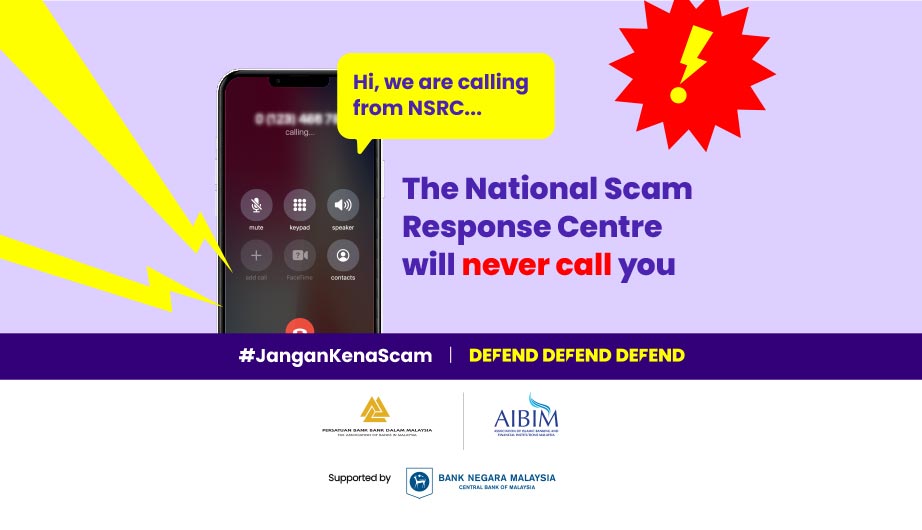

Beware of the new National Scam Response Centre (NSRC) scam!

Do not entertain calls from scammers posing as NSRC officers.

If you’ve been scammed, immediately call UOB’s 24/7 Fraud hotline at 03-2612 8100 or the National Scam Response Centre at 997 (8am-8pm daily) and make a police report. #JanganKenaScam

Berwaspada dengan tawaran luar biasa dan jangan sesekali muat turun apa-apa fail .APK!

Jika terkena scam, segera hubungi Hotline Fraud 24/7 UOB di 03-2612 8100 atau Pusat Respons Scam Kebangsaan di 997 (8am - 8pm, setiap hari) dan buat laporan polis. #JanganKenaScam

Waspada dengan fail .APK. Elak jadi mangsa Scam Perisian Hasad.

Jangan klik pada pautan yang mencurigakan dan hanya muat turun aplikasi dari laman web rasmi. Jika terkena scam, segera hubungi Hotline Fraud 24/7 UOB di 03-2612 8100 atau Pusat Respons Scam Kebangsaan di 997 (8am - 8pm, setiap hari) dan buat laporan polis. #JanganKenaScam

Berhati-hati dengan penipuan panggilan telefon

Jangan layan panggilan telefon yang meminta maklumat peribadi anda. Jika terkena scam, segera hubungi Hotline Fraud 24/7 UOB di 03-2612 8100 atau Pusat Respons Scam Kebangsaan di 997 (8am - 8pm, setiap hari) dan buat laporan polis. #JanganKenaScam

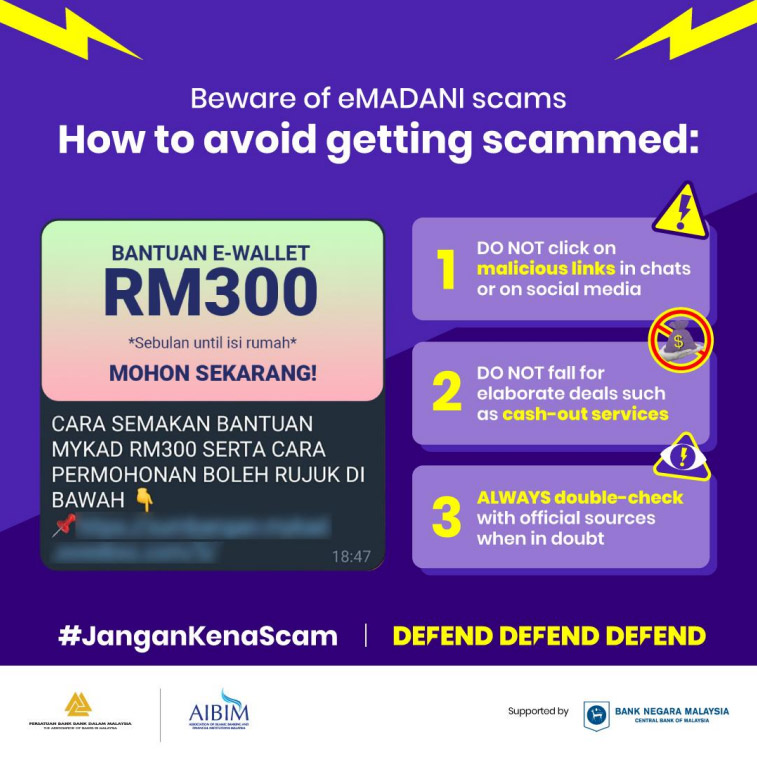

Waspada scam eMADANI

Pastikan anda hanya menebus kredit eMADANI melalui aplikasi rasmi! Jika terkena scam, segera hubungi Hotline Fraud 24/7 UOB di 03-2612 8100 atau Pusat Respons Scam Kebangsaan di 997 (8am - 8pm, setiap hari) dan buat laporan polis. #JanganKenaScam

Only download from official app stores.

Scammers can access your device via .APK files downloaded from unknown sources.

If you’ve been scammed, immediately call UOB’s 24/7 Fraud hotline at 03-2612 8100 or the National Scam Response Centre at 997 (8am-8pm daily) and make a police report.

#JanganKenaScam

Don’t share your banking info!

Check with official sources first! Banks won’t ask for your banking details. If you’ve been scammed, immediately call UOB’s 24/7 Fraud hotline at 03-2612 8100 or the National Scam Response Centre at 997 (8am-8pm daily) and make a police report. #JanganKenaScam

Don’t download that .APK file!

Scammers can use .APK files to take control of your device and steal your money! If you’ve been scammed, immediately call UOB’s 24/7 Fraud hotline at 03-2612 8100 or the National Scam Response Centre at 997 (8am-8pm daily) and make a police report. #JanganKenaScam

Protect Your Info from Scam Attacks!

Guard your personal info and defend yourself! Don’t share sensitive details with anyone. If you’ve been scammed, immediately call UOB’s 24/7 Fraud hotline at 03-2612 8100 or the National Scam Response Centre at 997 (8am-8pm daily) and make a police report. #JanganKenaScam

Jangan klik sebarang pautan dalam mesej!

Semak dahulu dengan sumber rasmi dan jangan kongsi butiran bank dengan sesiapa. Jika terkena scam, segera hubungi Hotline Fraud 24/7 UOB di 03-2612 8100 atau Pusat Respons Scam Kebangsaan di 997 (8am - 8pm, setiap hari) dan buat laporan polis. #JanganKenaScam

Kuiz: Bolehkah anda mengelak scam?

Jawab kuiz ini untuk melihat kehebatan anda dalam membezakan jenis-jenis scam dan defend diri anda daripada scammer!

Layari https://www.jangankenascam.com/my/kuiz/ sekarang!

Waspada dengan desakan scammer

Letakkan panggilan yang mencurigakan dengan segera. Jika terkena scam, segera hubungi Hotline Fraud 24/7 UOB di 03-2612 8100 atau Pusat Respons Scam Kebangsaan di 997 (8am - 8pm, setiap hari) dan buat laporan polis. #JanganKenaScam

Amaran Scam: Jangan terpedaya dengan penyamar!

Scammer akan menyamar sebagai pihak berkuasa dan mengugut anda. Jangan sesekali memindahkan wang kepada mereka! Jika terkena scam, segera hubungi Hotline Fraud 24/7 UOB di 03-2612 8100 atau Pusat Respons Scam Kebangsaan di 997 (8am - 8pm, setiap hari) dan buat laporan polis. #JanganKenaScam

Scam apps: How to spot and avoid them

Scam apps: How to spot and avoid them

Did you know that one of the top scams are scam apps? Scam apps are especially dangerous because of how they can control your device and steal your money!

How do scam apps get onto your devices?

Scammers will first trick you into chatting with them (via online ads for cleaning services and promotions or via dating app chats). Then, they will send you an .apk file or link to install an unverified app.

Once you download the app, the scammer will be minutes away from hacking your device.

Safety tip: Don’t ever tap on files or links sent through chats.

What can scam apps actually do?

- Control your device, access your apps and make/approve transfers

- Lead you to fake payment pages that sends your bank username and password directly to the scammer

- Steal your SMSes which contain your TAC/OTP number

How do you avoid scam apps?

- NEVER download apps via chat or links (.apk file)

- NEVER ALLOW permission for apps to view/control/access your device

- NEVER jailbreak/root your devices

Suspect you’ve been scammed? Here’s what you should do

Immediately call UOB’s 24/7 Fraud hotline at 03-2612 8100 or the National Scam Response Center (NSRC) at 997, and make a police report.

Stay safe and stay tuned to the hashtag #JanganKenaScam on social media for more scam alerts and online safety tips!

What do you know about scams? We want to hear from you!

We take your concerns about scams very seriously and always strive to do better.

As part of our continuous scam awareness efforts, we’re working with Rakuten Insights to better understand your concerns about scams and fraud.

Your feedback will help us create better educational content for you.

This will only take a short time and we would highly appreciate if you could tell us what you think:

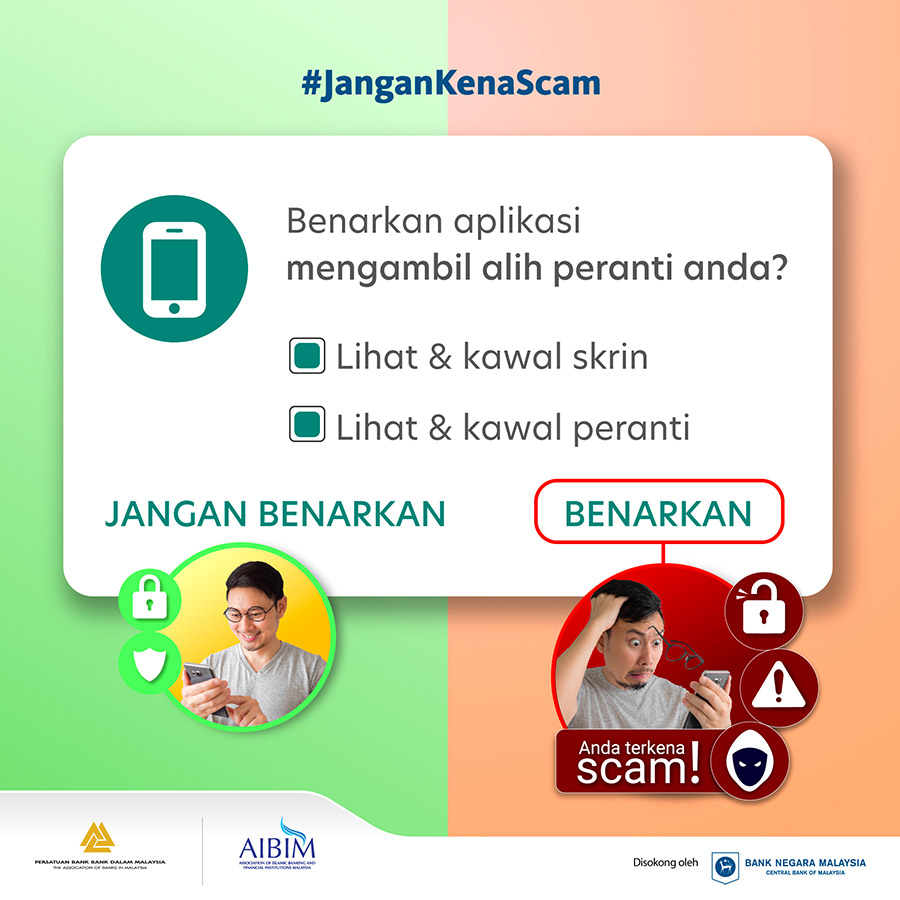

Tekan 'Jangan Benarkan', halang aplikasi scam

Berwaspada dengan aplikasi yang mencurigakan. Jika terdapat paparan meminta kebenaran untuk mengambil alih peranti anda, jangan benarkan dan padam aplikasi tersebut. Jika terkena scam, segera hubungi 03-2612 8100 atau Pusat Respons Scam Kebangsaan di 997 (8am - 8pm, setiap hari) dan buat laporan polis.

#JanganKenaScam

Scam Alert: Fake restaurant booking apps

Scammers are making fake profiles on dating apps! Remember to never tap on links sent via chats. These could be fake websites with fake app store icons that download scam apps to hack your device. If you’ve been scammed, immediately call UOB’s 24/7 Fraud hotline at 03-2612 8100 or the National Scam Response Centre at 997 (8am-8pm daily) and make a police report.

#JanganKenaScam

Beware of tax scams!

Scammers are pretending to be LHDN. If you receive phone calls, emails or SMSes about tax payments or refunds, it’s a scam. Here are some tips:

-

Never transfer to unknown bank accounts.

-

LHDN officers/authorities will never ask for your username and password.

-

LHDN will not ask you to click on links to receive tax refunds. If you’ve been scammed, immediately call UOB’s 24/7 Fraud hotline at 03-2612 8100 or the National Scam Response Centre at 997 (8am-8pm daily) and make a police report.

London Interbank Offered Rate (LIBOR) Cessation by 31 December 2021

Bank Negara Malaysia’s LIBOR transition signposts requires UOB Malaysia to cease new issuance of LIBOR referencing contracts by 31 December 2021. On 22 October 2021, BNM published an e-brochure that emphasises the urgency for bank customers to be prepared for the transition from LIBOR to RFRs.

Please download the brochure for more information.

Technical Briefing and Promotional Materials for Virtual Financial Advisory Clinic (VFAC) in conjunction with the Financial Literacy Month 2021 (FLM 2

For registration, please click here - https://www.fenetwork.my/flm2021/finale/register/