Achieve your short-term financial goals with PRUEzy Saver

|

|

Benefits

4.2% p.a. guaranteed payout

Receive annual guaranteed payout of 4.2%* of Total Premium Paid for the next 2 years.

Receive 100% of Total Premium Paid

100% of Total Premium Paid will be payable upon maturity.

Insurance protection

Enjoy insurance protection of up to 110% of Total Premium Paid for Death and Total and Permanent Disability (TPD).

Simple and Hassle-free

Get an online quote instantly, no medical underwriting is required.

|

*Terms and conditions apply.

|

Here’s how it works:

|

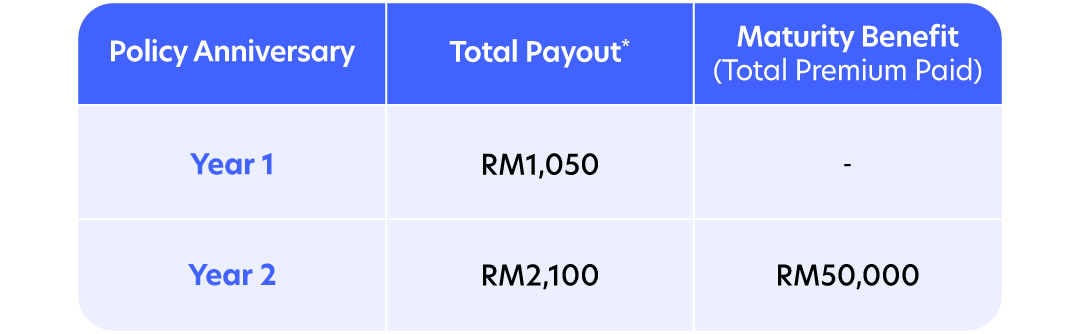

For example, your annual premium is RM25,000 |

|

During the 2-year policy term, you will receive the total payout* and Maturity Benefit as illustrated below. The coverage ends upon maturity of your policy. |

|

*This consists of Guaranteed Annual Income of 2.2% of Total Premium Paid and campaign payout of 2.0% of Total Premium Paid. It is payable until death/TPD, surrender or maturity of the policy, whichever is earlier and subject to campaign terms and conditions.

|

More Information

Eligibility

The plan is offered to individuals who:

- are a UOB Malaysia customer with existing UOB Malaysia savings or current account;

- are a Malaysian citizen currently residing in Malaysia;

- are not born in United States of America;

- are a tax resident in Malaysia only;

- are aged from age next birthday of 17 to 70 (both ages inclusive); and

- do not own any active policy/certificate in the Non-eligible Product Listing; subject to Prudential Assurance Malaysia Berhad (PAMB)’s acceptance of cover.

Please note that the above eligibility criteria, are amongst the information that is relevant to PAMB’s decision on whether to issue the policy. As such, if you give PAMB any incorrect information, your insurance coverage may be avoided.

Premium payment

Annual premium

Minimum: RM1,000*

Maximum: RM50,000 per customer per tranche

*Note: Premium amount must be in the multiple of RM1,000.

Payment mode

Annual payment via Malaysian Debit/Credit Card (Visa/Mastercard) only

Premium payment and policy term

2 years

Exclusions

- Suicide – if death was due to suicide within one year from the effective date of policy, all premiums paid (excluding taxes, if any) will be returned without interest.

- Total and Permanent Disability (TPD) Benefit is not payable if the disability is directly or indirectly caused by:

- any pre-existing conditions;

- any attempted suicide or self-inflicted injury whether attempted/inflicted while sane or insane;

- any travelling in an aircraft other than as a pilot or a member of a crew or a fare paying passenger in a commercial aircraft licensed for passenger service on scheduled flights over established routes only; or

- any participation in any aerial sporting activities such as hang-gliding, ballooning, parachuting, sky-diving, bungee jumping and other such similar activities.

Note: This list is non-exhaustive. Please refer to Product Disclosure Sheet for further information.

How to Apply

Complete your personal details

Complete the payment process

Disclaimer

Underwritten by:

The above plans are underwritten by Prudential Assurance Malaysia Berhad 198301012262 (107655-U) and distributed by United Overseas Bank (Malaysia) Bhd 199301017069 (271809-K). All claims and liabilities arising from the policies should be made with the company.

Prudential Assurance Malaysia Berhad is a licensed insurance company and is regulated by Bank Negara Malaysia. Prudential Assurance Malaysia Berhad is responsible for the products and benefits offered by them, as well as any representation made in any of their marketing materials including United Overseas Bank (Malaysia) Bhd’s marketing material for the products offered by Prudential Assurance Malaysia Berhad.

This content contains only a brief description of the product and is not exhaustive. You are advised to refer to the Product Summary, Product Disclosure Sheet and FAQ for further information before purchasing a policy, and to refer to the terms and conditions in the policy contract for details of the features and benefits, exclusions, and waiting periods (where applicable) under the policy.

The premiums/contributions that you pay contribute to both the savings and protection elements of the product, e.g. death benefits. If you are looking for financial products with savings element, you may wish to compare annualised returns of this policy/takaful certificate with the effective returns of other investment alternatives.

You should satisfy yourself that this policy will best serve your needs and that the premium payable under the policy is an amount that you can afford.

The benefit(s) payable under eligible certificate/policy is(are) protected by Perbadanan Insurans Deposit Malaysia (“PIDM”) up to limits. Please refer to PIDM’s Takaful and Insurance Benefits Protection System (“TIPS”) Brochure or contact Prudential Assurance Malaysia Berhad or PIDM (visit www.pidm.gov.my ).